Good growth is forecast in the LVT market over the next few years, according to a report recently published by flooring research specialists Leading Edge.

With economic and construction activity set to recover after Covid-19, Leading Edge estimates an 8% growth for 2021 LVT volume compared to 2020.

Construction sectors that are important for LVT will see steady increases in activity and LVT will continue to grow its share of the flooring sector, albeit at a slower rate than in previous years. The most used LVT brands are Karndean, Amtico, Polyflor, Moduleo and Forbo with 87% of flooring contractors having used Karndean at least once in the previous 12 months.

Moduleo is a relatively new LVT brand in the market but are now the fourth most used brand with more than 30% of contractors having used it at least once in the previous 12 months. Note these % figures are different to market share – details on brand share and changes over the years are in the report.

The carpet tile brands Interface and Milliken have featured in the list of brands used by flooring contractors for the first time, LVT is a relatively new addition for these two brands. Gerflor has seen a decrease in use of the brand in 2020.

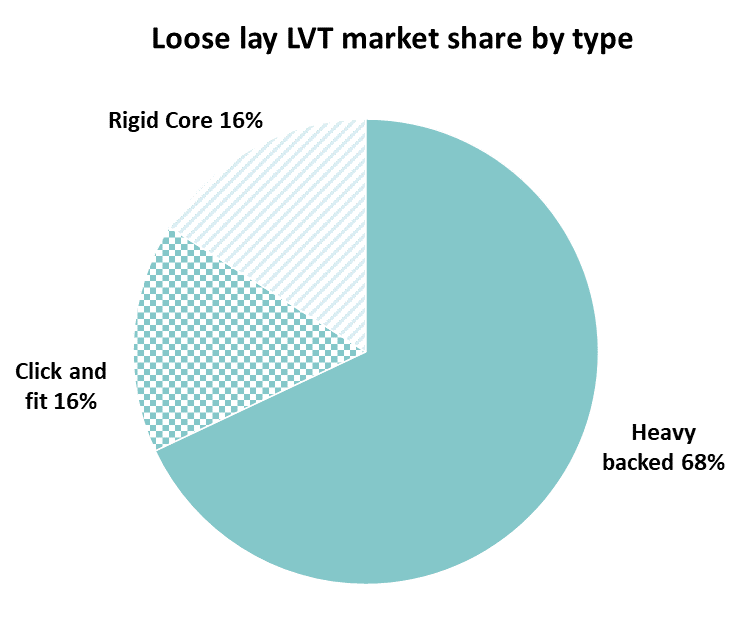

Looselay LVTs’ share of the overall market has more than doubled since 2017. Heavy backed looselay has the largest market share of the loose lay market in 2021. Click and Fit and Rigid Core have an equal portion of the market with rigid core having seen rapid growth since 2017.

The proportion of contractors who never use looselay has been hovering around half for the three previous surveys, but there is an increase in the number of contractors regularly using it.

Respondents were also asked to rate all the main brands on a number of key attributes such as price, quality, specification, and design. When asked to rate the best supplier for ‘product quality’, Amtico was rated number one – a position it has consistently held since the 2008 survey.

Flooring contractors favour those brands they are familiar with and can trust. There is a reluctance to change brands unless forced to by a specification or if a price is particularly attractive.

The top two reasons for contractors selecting the supplier they do is that the brand is specified (42% of contractors mentioned this) and that the price is attractive (23%). These are the same two top reasons as in 2017. The % giving specification as the main reason was similar in the last three reports (43% in 2017 and 41% in 2014).

The full report contains details on many other areas including:

• Market size by type of LVT

• Market share by sector 2006 – 21 eg retail, health/education, offices

• Market share by brand with trends

• Market changes by design type

• Reasons for selecting each brand

• Market changes for loose lay LVT by brand

• What flooring contractors would like to improve about their LVT supplier

• Ratings of all brands.

• The specification market

• Pricing

The LVT report is primarily based on an extensive phone interview programme with flooring contractors. The key sources of data are as follows:

• Phone market research programme with 100 flooring contractors

• Desk research

• Discussions with LVT manufacturers and distributors

• Data from previous reports published in 2006, 2008, 2011, 2014 and 2017.