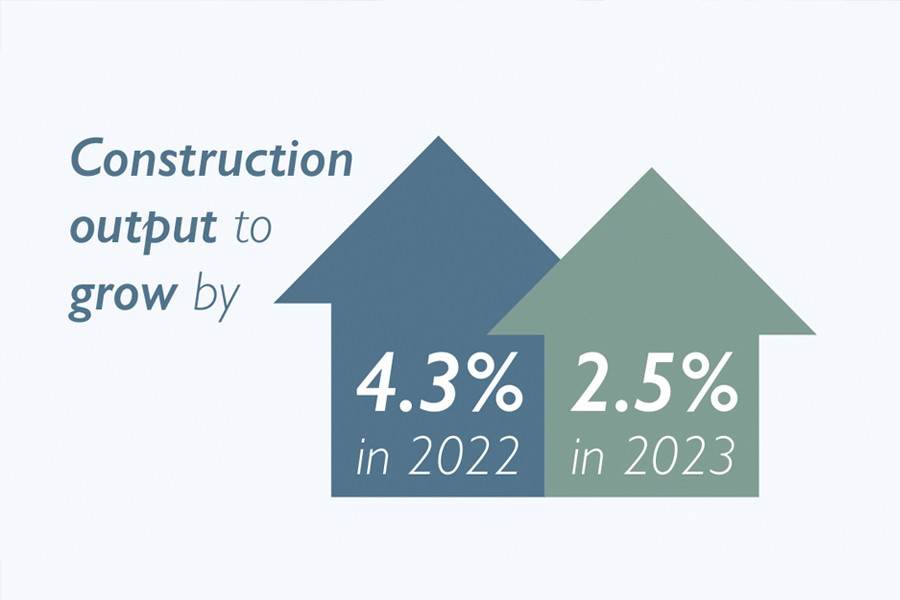

IN its latest quarterly forecast, the Construction Products Association (CPA) forecasts that output in the construction products industry will grow by a robust 4.3% in 2022, slowing to 2.5% in 2023 compared to the 13.3% seen in 2021. This demonstrates the remarkable resilience of the sector to the initial Covid-19 lockdown and the end of the Brexit transition period in 2020.

Housebuilding, the largest sector within the UK construction industry, is expected to remain buoyant while infrastructure will be the major driver for growth. Projects already underway in all sectors give great confidence for the forecast figures.

Product supply issues, a major challenge in 2021, have eased recently, but may still cause problems, particularly in the peak spring period and particularly for smaller building companies. Continuing to benefit from the ‘race for space’, output in private housing is forecast to rise by 3.0% in 2022 and 2023 following 17.0% growth in 2021.

CPA suggests the double-digit inflation in house prices will fall as the impact of the end of the stamp duty holiday and the further restriction of the help-to-buy scheme feeds through. The outlook for volume remains positive, with most major house builders reporting strong near-term demand and healthy profit margins fuelled by demand for housing in affordable areas of the UK.

Also benefiting from the ‘race for space’ in the near-term is the private housing rm&i sector. Here the CPA forecasts output to remain flat at the historically high level reached with 17.0% growth last year. Rising renovation project costs and higher inflation rates are expected to slow down consumer spending on larger projects. UK households have benefited from building up over £200bn of savings from the past two years but rising costs are spelling caution for spending compared to 2021.

CPA winter forecast indicates the infrastructure sector to remain as the main driver for growth in 2022. This mirrors the CPA autumn forecast which pointed to the five-year spending plans within the regulated sectors of rail, water, roads, and energy, allowing the sector to maintain activity levels and weather supply issues.

Key projects include the Thames Tideway Tunnel, Hinkley Point C and HS2. At least two of these projects report delays owing to supply constraints and this could result in further work being pushed into 2023. Taking this into account, the sector is still expected to rise by 9.7% in 2022 and 1.1% in 2023, taking the sector to a new all-time high.

While supply issues have eased off over the past six months, the CPA still considers these to be the biggest challenge to overall growth. Questions over sufficient materials, products, labour, HGV drivers, and imports will be at the forefront of industry minds. These challenges aren’t spread equally across the sector, with smaller specialist sub-contractors feeling the pressure more.

Noble Francis, CPA economics director, offered this insight into the supply chain issues: ‘Major house builders and main contractors are less affected as they have better visibility of medium-term demand and can plan and purchase well in advance; plus, they’re the larger customers of the manufacturers, builders’ merchants and importers.

‘Smaller firms, however, have found availability issues have delayed projects and, consequently, revenue streams whilst sharp cost increases have hit margin, harming their viability even though they have strong workloads. Overall, the latest indications are that supply issues have eased recently, which is a positive sign, although it’s still early in the year and before industry activity tends to ramp up in spring.’

www.constructionproducts.org.uk

Please click to view more articles about

News